Treatment of CA pre-pioneer pioneer post pioneer. Tax for sending money from USA to India.

This means that the 30 is quarantined for tax.

. Exemption on Increase of Chargeable Business Income. Newly Proposed Foreign Sourced Passive Income Tax Exemption in Hong Kong. 32019 of Inland Revenue Board of Malaysia.

EXEMPTION OF INCOME OF REPRESENTATIVES OF CLUBS ETC. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. If youre in the US and want to send money to family members in India as a gift per the IRS the amount is excluded from taxes under the Gift Tax for gifts up to 15000 USD per year.

Starting from 1 January 2019 the deadline is extended to three years. UNICEF Malaysia adheres to a strict policy regarding donor. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the.

These tax incentives appear in various forms such as EXEMPTION ON INCOME EXTRA ALLOWANCES ON CAPITAL EXPENDITURE INCURRED DOUBLE DEDUCTION OF EXPENSES SPECIAL DEDUCTION OF EXPENSES PREFERENTIAL TAX TREATMENTS FOR PROMOTED SECTORS EXEMPTION OF IMPORT DUTY AND EXCISE DUTY Malaysia offers a wide range of. The balance of 30 is leap-frogged to the total income stage to form part or whole of the total income of the pioneer company. As per the revised tax exemption act effective April 1 2017 When you make donations above 500 to Akshaya Patra your donation amount will be eligible for 50 tax exemption under Section 80G of Income Tax Act.

In addition the tax credit is not limited to 25 of the donating companys gross tax payable less the deductions for international double taxation and tax relief for income obtained in Ceuta and Melilla for export activities and for local public services which is applicable for other tax credits see CIT relief in the Tax credits and. The Inland Revenue Board IRB or Lembaga Hasil Dalam Negeri Malaysia LHDN has announced that e-Filing submissions for Income Tax Returns for the 2021 year of assessment YA 2021 will start from March 1. Approved charitable donation is allowed if the aggregate of such donations is not less than HKD 100.

Is exempt from income tax. Zakah is levied annually on the wealth itself and not on the individual or income at a general rate of 2½ per annum. Other Incomes - Interest Discount Bank Negara Malaysia.

For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. For every donation of RM50 and above it is also tax exempt under Section 446 of the Income Tax Act 1967. The deductions vary depending on the kind of receiver which means that it may be 100 or 50 of the donation made.

Employers are eligible for tax deduction under Public Ruling No. Tax for sending money from UK to India. Because the purpose is redistribution of income and wealth without creating a class society zakah is levied on almost every one.

As long as youve earned an annual income of RM34000 or more for the year 2021 theres no escaping taxes. Donation to NGO. Approved donations and other deductions from aggregate income are by-passed see Illustration 2.

Consumption taxes Value-added tax VAT The VAT rates are 23 standard rate 8 5 0 and exemption. In order to benefit from the exemption the taxpayer should become the owner of the property. Exemption from tax when recognition withdrawn.

Even the not very well to do pay zakah. Read of income tax sections like section 80C 80CCD and other. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D.

Above 15000 USD as gifts will trigger a tax event in most cases⁴. Based on the income tax slab an individual falls into they do their maximum tax saving. Accounting Audit 1 Business Corporate Services.

Agreement Between The Government of Malaysia and The Government of the Republic of India for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income. The 1012 Tax Bracket. Income Tax Exemption for FY 2019-2020.

This maximum investment amount is decided by the government. If you are a one-time donor you will receive a donation receipt from UNICEF for every donation you make. However every section amongst these has a pre-set maximum investment amount.

Know about income tax deduction and exemptions in India. EXEMPTION OF REMUNERATION PAID TO NON-RESIDENT MEMBER OF COMMISSION OF INQUIRY. Eligible if the payment of compensation is due to ill health or termination after 172008 with an exemption of RM 10000 for every completed year of service with the same employersame groups companies.

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. The remuneration paid by the State to a non-resident as a Commissioner under the Commissions of Inquiry Act 1951 is exempt from income tax or salary and wages tax. Income-tax Second Amendment.

He may then receive the zakat of others at the same time. The exemption is calculated by reducing the. See Other taxes in the Corporate tax summary for more information.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Subject to Income Tax CbCR Country-by-Country Reporting Rules. Income tax season is upon us.

Interest Discount Deemed Interest Check ALR Rate in wwwbnmgovmy Bank Negara Malaysia. Exemption on Increase of Chargeable Business Income. The deduction is limited to 35 of the assessable profits of the year of assessment.

Amitabha Malaysiasubsidiary organization of Amitabha Foundation was set up to give these people a second chance we are set up to give them hope and that they may rejoin the society as a contributing force. Establishment of fund and trust. Will my credit card and bank account information remain confidential.

Difference Between Nonprofit And Charity Difference Between

Spca Seberang Perai Please Share Donate Before 31 Dec 2015 To Enjoy Tax Deduction 请在2015年12月31日前捐款以便享有所得税扣税 We Are Coming To An End Of 2015 As

Covid 19 Malaysian Tax Deductions For Donations Announced Raja Darryl Loh

![]()

Are Church Donations Tax Deductible Tithe Ly

Doc Donors Tax Mark Eric Punla Academia Edu

Shinee 21ct On Twitter Please Read And Rt Here I Would Like To Share The Gratitude And Official Receipt We Received For The Shinee10thanniversary Mini Fundraising Project By Irmalaysia On The Name Of

Donate To Susan G Komen To Help Fight Breast Cancer

Pdf Donating Behavior If Time Is Money Which To Give A Preliminary Analysis Published In Journal Of Economic Studies

Donate To Up2us Sports General Donation Page

Josie S Income Tax Service Facebook

Making Charitable Donations Of Stock Instead Of Cash After Tax Reform

Sample Problems Donors Tax Pdf Donation Payments

Gobald Frequently Asked Questions

Donate To Susan G Komen To Help Fight Breast Cancer

Charitable Donations Of S Corporation Stock Outright Donations And Stretching Deductions

Mleo1 Pdf Estate Tax In The United States Tax Deduction

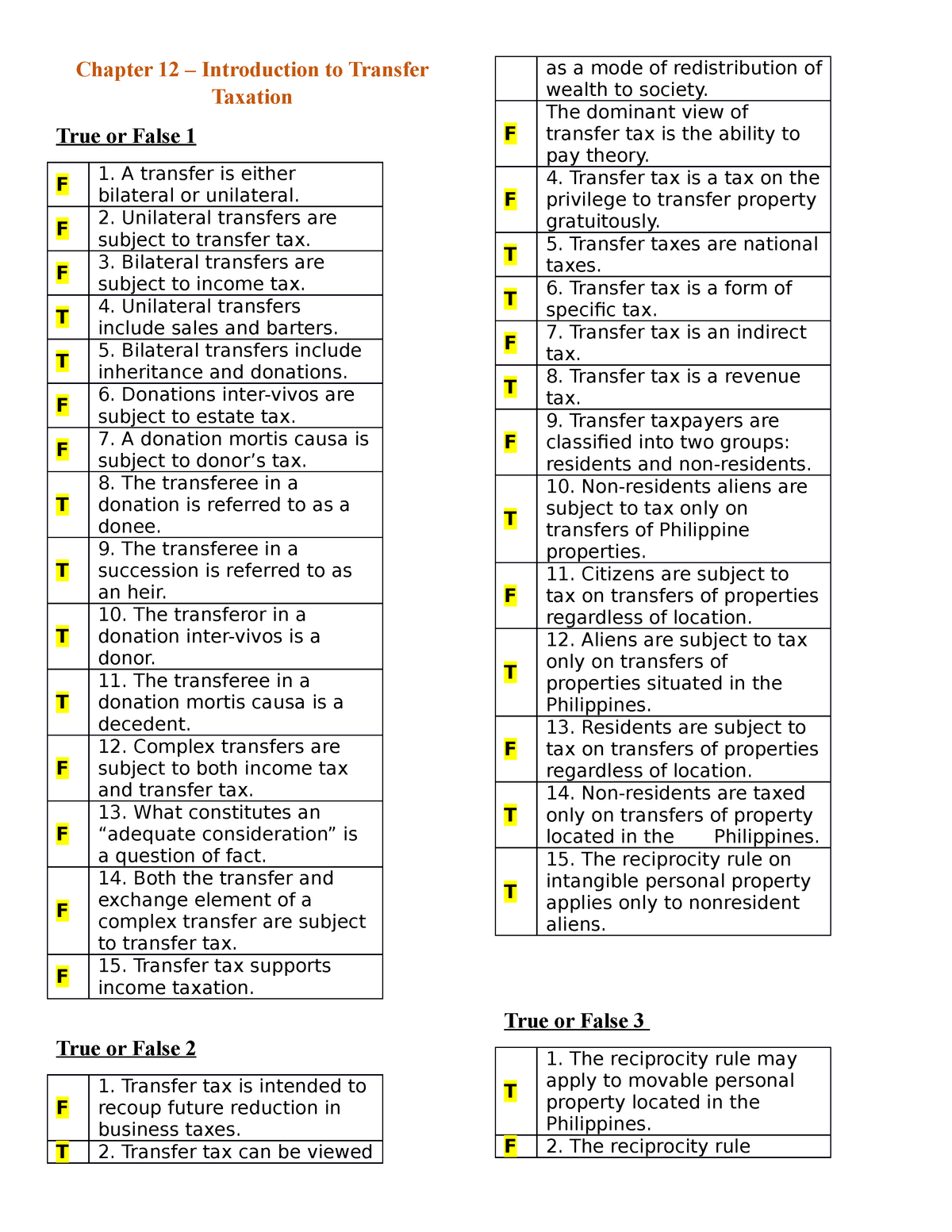

Exercises Chapter 12 And 13 Chapter 12 Introduction To Transfer Taxation True Or False 1 F A Studocu

Tax Deductibility Of Covid 19 Donations By Companies In Nigeria